4 in 10 Latino and Black households with children lack confidence that they can make their next housing payment, one year into COVID-19

Jun 29, 2021

Research Publication

4 in 10 Latino and Black households with children lack confidence that they can make their next housing payment, one year into COVID-19

Author

This data snapshot is part of a series documenting how Latino children, families, and households are faring during the COVID-19 pandemic and the subsequent recovery. Drawing from the latest publicly available data sources, each installation in the series examines a separate domain of child and family well-being and provides a brief overview of social and policy context relevant to the findings. Recent releases include a look at food insufficiency, along with other economic and health-related hardships experienced by Latino households with children during the pandemic.

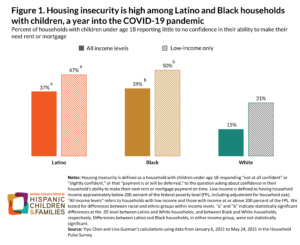

One year into the COVID-19 pandemic, roughly 40 percent of Latino and Black households with children who rent or have a mortgage reported housing insecurity, which we define as a household having little to no confidence in its ability to make its next mortgage or rent payment. This finding is from January to May 2021 data from the U.S. Census Bureau’s Household Pulse Survey, which also shows that 15 percent of White households with children experienced housing insecurity. Housing insecurity is even higher among households with low incomes (see methodology below). Roughly half of low-income Latino and Black households with children, and one third of low-income White households with children, reported little or no confidence in their ability to make their next mortgage or rent payment.

Context

Housing insecurity is associated with adverse child and adult outcomes, including poor child health and development, poor maternal health, and food insecurity. Ensuring housing security, critical at all times for child and family well-being, is of paramount importance during a global health pandemic. A household’s confidence in its ability to pay its rent or mortgage allows its members to better focus on other pressing challenges such as job loss and illness—challenges that have been disproportionately experienced by Latino and Black individuals and households during the pandemic. However, rising home prices and rental costs have outpaced income growth, resulting in a higher cost burden—especially in metropolitan areas, where Latino and Black families predominately reside. The legacy of discriminatory housing policies and practices exists in the form of suppressed homeownership, home equity, and wealth accumulation among Black, Latino, and immigrant families and communities, and has left them more vulnerable to the pandemic’s economic downturn.

To help families and communities weather the pandemic, a federal moratorium has temporarily prohibited evictions of tenants who are unable to pay rent; with a recent extension, this moratorium is now set to expire at the end of July 2021. Additionally, while the recent American Rescue Plan has offered more than $40 billion in housing assistance, local housing programs have faced challenges disbursing these emergency housing relief funds due to documentation requirements, staff capacity, and landlord cooperation. Addressing these hurdles and getting housing assistance to families and communities hit hard by the pandemic may not only improve their housing security and economic footing as we enter the pandemic’s recovery phase, but also boost overall child and family well-being.

Methodology

We drew data for January 6 to May 24, 2021 from the U.S. Census Bureau’s Household Pulse Survey to focus on the latest trends in housing during the pandemic. The Household Pulse Survey is a nationally representative survey of U.S. households that aims to capture their experiences during the COVID-19 pandemic. We limited our analytic sample to Hispanic, non-Hispanic Black, and non-Hispanic White households with children under age 18 who also reported renting or owning a home with a mortgage. We relied on the respondent’s report of their race and ethnicity to identify Hispanic, non-Hispanic Black, and non-Hispanic White households. We use the terms “Hispanic” and “Latino” interchangeably.

In the survey, respondents first reported housing tenure (owned free and clear, owned with a mortgage, rented, occupied without payment). Those who rented or owned a home with a mortgage were asked how confident they were about making their next rent or mortgage payment. We defined housing insecurity as households reporting “not at all confident” or “slightly confident,” or that “payment is or will be deferred” (less than 2% of all households chose deferred payments). Our measure for housing insecurity is similar to the Centers for Disease Control and Prevention’s measure, which defines three levels of housing insecurity as, respectively, being worried or stressed “always/usually,” “sometimes,” or “rarely/never” about having money to pay rent or mortgage in the past 12 months. Other available measures include a national housing security index that includes multiple domains of housing insecurity (i.e., housing affordability, quality, and instability), but this index is still under development. We focused on confidence paying rent or mortgage because this measure has broader implications for child development and family stress.

“Low-income” is defined as having a pre-pandemic household income of roughly 200 percent of the federal poverty threshold. Specifically, since only ranges of incomes are available from Pulse data, we considered the following households to be low-income: any households with incomes under $25,000; households with at least two persons and incomes under $35,000; households with at least three persons and incomes under $50,000; households with at least five persons and incomes under $75,000; and households with at least eight persons and incomes under $100,000. We conducted multiple imputations for missing reports of lower confidence (0.4%) and household incomes (6.9%) in the sample of all households with children that reported having to pay rent or mortgage, and then applied the household weights provided by the Census Bureau to obtain our estimates for housing insecurity rates among Latino, Black, and White households with children. We tested for differences across racial and ethnic groups within income levels; differences reported here are at the .05 level or below.

Although we only examined housing insecurity for Latino, Black, and White households with children, we recognize other potential heterogeneity in housing insecurity among these and other racial and ethnic groups. Many Latino, Black, and Asian immigrants, for example, faced housing challenges and had limited access to housing assistance during the pandemic. However, data to disaggregate by immigrant status—as well as by other kinds of diversity within the three racial and ethnic groups considered here—are not available in the Pulse survey. Finally, we acknowledge another limitation of this data: It cannot capture other forms of housing hardship, such as doubling up without a rent payment, overcrowding, and homelessness.

Suggested Citation:

Chen, Y., & Guzman, L. (2021). 4 in 10 Latino and Black households with children lack confidence that they can make their next housing payment, one year into COVID-19. National Research Center on Hispanic Children & Families. https://doi.org/10.59377/844z2079t

Copyright 2025 by the National Research Center on Hispanic Children & Families.

This website is supported by Grant Number 90PH0032 from the Office of Planning, Research & Evaluation within the Administration for Children and Families, a division of the U.S. Department of Health and Human Services totaling $7.84 million with 99 percentage funded by ACF/HHS and 1 percentage funded by non-government sources. Neither the Administration for Children and Families nor any of its components operate, control, are responsible for, or necessarily endorse this website (including, without limitation, its content, technical infrastructure, and policies, and any services or tools provided). The opinions, findings, conclusions, and recommendations expressed are those of the author(s) and do not necessarily reflect the views of the Administration for Children and Families and the Office of Planning, Research & Evaluation.